When Does an Estate Need to Go Through Probate? Common Misconceptions

When a loved one passes, there’s often confusion around whether their estate must go through probate. You may have heard that probate is inevitable—or maybe you’ve been told it’s avoidable altogether. The truth lies in understanding how assets are titled, whether a will exists, and what state law requires. At Peabody Law Firm, we help […]

The Role of Mediation in Probate Disputes: Avoiding Court Battles

Probate disputes can strain family relationships, exhaust estate assets, and drag on for months—or even years. Courts are often slow, impersonal, and expensive. Fortunately, there is an alternative that prioritizes peace, privacy, and speed: mediation. By bringing a neutral third-party facilitator early in the process, families can resolve conflicts without the emotional and financial toll […]

How to Resolve Probate Disputes Without Costly Litigation

When a loved one passes away, emotions run high—and with them, the potential for probate disputes. Whether it’s a contested will, competing claims from beneficiaries, creditor issues, or executor misconduct, probate disputes can quickly become messy. Lengthy court battles drain estates, damage family relationships, and drain inherited assets. The good news is—many probate conflicts can […]

How to Prevent Family Conflict During Probate and Estate Settlements

When a loved one passes away, grief and emotion often collide with financial matters. Probate and estate settlements can exacerbate tensions, turning heartbreak into disputes. But with thoughtful planning and open communication, families can navigate these difficult moments with compassion and clarity. At Peabody Law Firm, we work closely with families in Southlake, Westlake, Trophy […]

How to Handle Foreign Assets in a U.S. Probate Case

When someone dies owning property or accounts outside the United States, the administration of their estate becomes considerably more complex. Foreign assets often require dual legal processes, specialized tax filings, and careful coordination between jurisdictions. Without strategic planning, U.S. executors may face delays, increased costs, and legal entanglements both at home and abroad. At Peabody […]

Understanding the Legal and Financial Responsibilities of an Executor

When someone passes away, their estate—their assets, debts, and personal affairs—must be settled and distributed according to their will (or by law if there is no will). The person responsible for managing this process is known as the executor. While this role is often seen as an honor, it is also a significant legal and […]

Probate or Trust Administration: Which Option is Right for Your Estate?

When it comes to passing on your legacy, one of the most important choices in your estate plan is deciding whether your assets will be handled through probate or trust administration. While both processes aim to transfer property and settle affairs after someone passes, they operate very differently—and one may be significantly more advantageous depending […]

Probate and Guardianship: Planning for Minor Children in Your Estate

When you have children—especially young ones—estate planning takes on a whole new level of importance. It’s not just about protecting your assets; it’s about ensuring that your children are cared for by the people you trust most, both emotionally and financially. Without a legally sound estate plan, the future of your children could be left […]

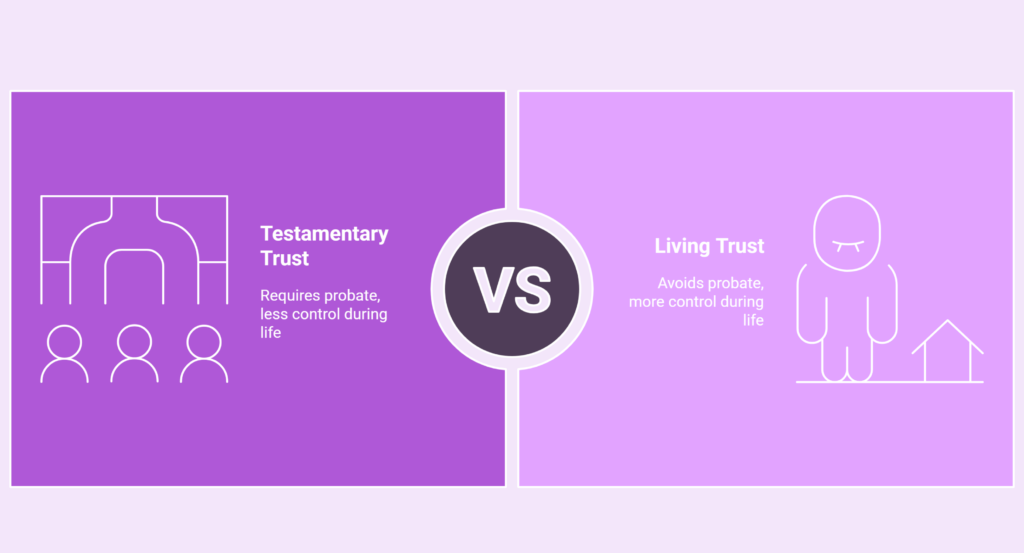

Key Differences Between Testamentary Trusts and Living Trusts in Probate

When it comes to safeguarding your assets and planning for how they’ll be distributed after your death, trusts are one of the most powerful tools in estate planning. Two of the most common types—testamentary trusts and living trusts—are frequently used to manage wealth, protect beneficiaries, and reduce legal complications. However, they operate in fundamentally different […]

Avoiding Probate Delays: Proactive Steps to Speed Up Estate Settlements

Probate often has a reputation for being slow, public, and emotionally exhausting—especially for families already dealing with the grief of losing a loved one. While the process is designed to ensure the fair and legal transfer of assets, delays are common and can last for months or even years depending on the complexity of the […]