When you have children—especially young ones—estate planning takes on a whole new level of importance. It’s not just about protecting your assets; it’s about ensuring that your children are cared for by the people you trust most, both emotionally and financially.

Without a legally sound estate plan, the future of your children could be left up to court decisions, which may or may not reflect your wishes.

At Peabody Law Firm, we assist parents throughout Southlake, Westlake, Trophy Club, Colleyville, Keller, and surrounding communities in creating estate plans that go beyond asset distribution and provide a safety net for their children in case of the unthinkable.

A crucial piece of this planning includes naming guardians and understanding how probate and guardianship proceedings work when minor children are involved.

Why Guardianship Planning Is Essential

If you pass away with minor children and don’t have a clear guardianship plan in place, a Texas court will be forced to decide who will care for your children. This process can be time-consuming, emotionally charged, and potentially result in a decision that doesn’t reflect your values or your children’s best interests.

Even if you assume a family member will “step in,” that person must be legally appointed as guardian by the court—and without direction from your estate plan, competing claims or uncertainty can lead to disputes and delays in care.

Estate planning gives you the power to:

- Choose who will raise your children

- Establish a financial structure for their care

- Minimize court involvement and confusion

- Ensure continuity and emotional stability for your children

The Two Types of Guardianship You Need to Plan For

When planning for minor children, it’s important to understand that guardianship falls into two categories:

1. Guardian of the Person

This is the individual who will be responsible for your child’s day-to-day care, including education, health decisions, and upbringing. This should be someone whose values align with yours and who has the emotional and logistical capacity to care for children.

2. Guardian of the Estate (or Property)

This person manages the financial assets and property left for your children until they reach adulthood or another age specified in your estate plan. It can be the same person as the guardian of the person—or a separate individual or professional fiduciary, especially if the estate is large or complex.

In many cases, parents name a guardian of the person in their will and create a trust to hold and distribute financial assets under the management of a trustee, which may or may not be the same individual.

How Probate and Guardianship Interact

If a parent dies without a will or trust naming a guardian, the Texas probate court steps in. Here’s how it typically plays out:

- The court opens a probate proceeding to validate the will (if one exists).

- If the will names a guardian, the court will usually honor the choice unless there are compelling reasons not to.

- If there’s no guardian named, the court considers petitions from family members or others and decides who should take on the role.

- The process includes background checks, hearings, and potential objections, which can slow things down and cause family conflict.

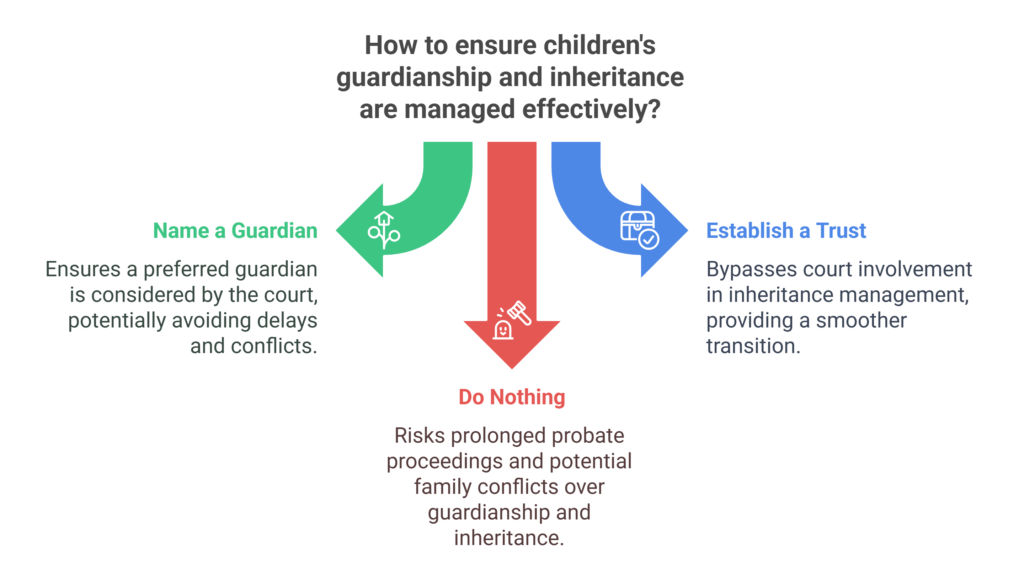

- The court also oversees the management of your children’s inheritance—unless you’ve created a trust, which can bypass court involvement.

By proactively naming guardians and establishing a trust, you reduce the risk of prolonged probate proceedings and ensure that your children are not caught in legal limbo.

Using a Will and Trust to Protect Your Children

The most effective way to address both guardianship and inheritance planning is to combine a Last Will and Testament with a Revocable Living Trust. Here’s how each helps:

- Your Will: Allows you to name a guardian for your children and direct how any property outside of your trust is to be distributed.

- Your Trust: Holds your assets and allows for the private, court-free distribution of funds to a trustee, who will manage them for your children until they reach the age you’ve designated (often 25 or 30 instead of 18).

- Pour-Over Will: Acts as a backup to ensure that any assets not titled in the trust at the time of your death are transferred into it.

This combination gives you control, flexibility, and a more seamless process for everyone involved.

Choosing the Right Guardian

This is often the hardest—and most emotional—part of estate planning for parents. Some things to consider:

- Does this person share your parenting values?

- Are they emotionally and physically able to care for children?

- Where do they live, and would a move disrupt your child’s life?

- Do they have a stable lifestyle and finances?

- Are they willing to accept the role?

It’s okay to revisit this decision over time. People’s circumstances change, and so can your preferences.

Communicating with Family and Your Chosen Guardians

Once you’ve made your selections, talk to your chosen guardians. Make sure they understand what’s involved and are willing to accept the role. Consider writing a Letter of Intent—a non-legal document that shares your wishes about your child’s upbringing, education, religious beliefs, and other values.

Also, inform family members about your choices to help avoid confusion or disputes if something were to happen.

Final Thoughts: Peace of Mind for You, Stability for Your Children

No one wants to imagine a scenario where their children are left without them—but having a solid guardianship plan is one of the greatest gifts you can leave your children.

It provides structure during uncertainty, minimizes emotional and financial disruptions, and ensures that your children are cared for in the way you would have wanted.

At Peabody Law Firm, we understand the sensitivities and complexities involved in planning for minor children. We work with families throughout Southlake, Westlake, Trophy Club, Colleyville, Keller, and neighboring areas to create estate plans that offer peace of mind and clear legal protection.

Contact Peabody Law Firm today to schedule a confidential consultation and start building an estate plan that safeguards your children’s future.

Legal Disclaimer

This article is for educational purposes only and does not constitute official legal or financial advice. Estate planning laws are complex and subject to change. Individuals should consult with a licensed estate planning attorney to determine the best strategies for their unique situation.